Employees’ Provident Fund (EPF) is a government retirement savings scheme designed to provide financial security to employees after retirement. The Employees’ Provident Fund Organization (EPFO), under the Ministry of Labor and Employment, is responsible for managing the scheme. Both the company and the employee contribute equal amounts to the savings. The amount deposited in the EPF continues to grow over time until the employee retires. Additionally, every salaried employee earning up to Rs 15,000 per month is required to contribute to the EPF, with equal contributions from both the company and the employee.

Full Details of Money Deposited in EPF

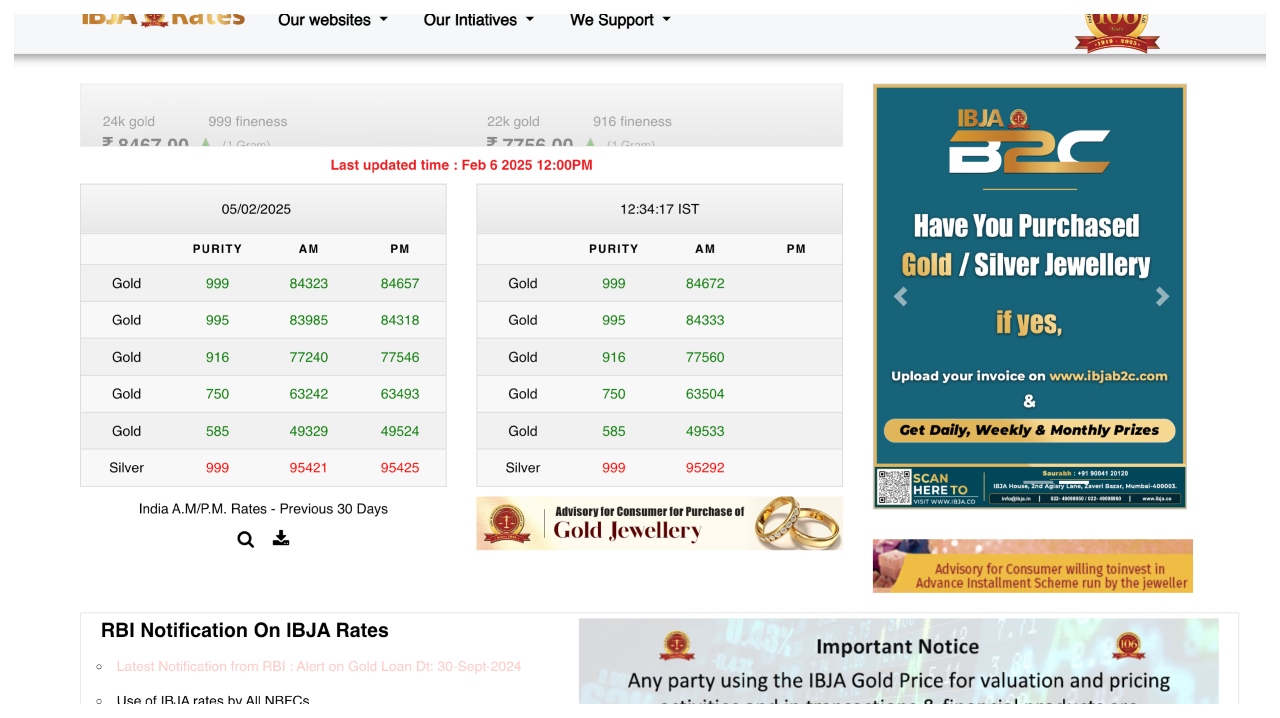

Every year, the government fixes the interest rate for EPF. The EPFO Central Board of Trustees usually changes it after consulting with the Finance Ministry. For the financial year 2024-25, the interest rate has been set at 8.33%. The money deposited in the EPF account can only be withdrawn during retirement, job change, or in specific emergency situations. However, if the EPF balance is withdrawn before completing 5 years of service, the withdrawal becomes taxable. Contributions made to EPF are eligible for a tax deduction under Section 80C of the Income Tax Act, and the interest earned on EPF contributions is tax-free.

How Does EPF Work?

In the EPF scheme, employees contribute a portion of their salary. The employer also deposits an equal amount into the EPF scheme. This combined contribution is then deposited into the EPFO. The amount in the EPF account earns interest at a fixed rate, which is credited annually by the EPFO. For example, if you contribute Rs 7,000 to EPF each month from your salary, your employer will also contribute Rs 7,000, making a total of Rs 14,000 deposited into the EPFO.

Interest is earned on this total amount (currently 8.33% per annum), and it is deposited annually. This interest rate may change each year when the EPFO reviews and determines the rate. According to the law, the EPF contribution is 12% of the employee’s basic salary and dearness allowance (DA).