Post Office RD Scheme Update: If you’re looking to invest your savings in a reliable scheme with good returns, this news is for you. Today, we are going to introduce a great investment option from the post office, where you can become a millionaire in a few years by investing just ₹5,000. The scheme is called the Recurring Deposit Scheme.

With this scheme, you can invest a fixed amount every month and accumulate over ₹8 lakh in just a few years. Currently, the interest rate offered is 6.7 per cent. The maturity period of this scheme is five years, but after five years, you can extend the investment for another five years. You can easily open an account in the Recurring Deposit Scheme by visiting your nearest post office. The best part of this scheme is that you can start investing with as little as 100 rupees.

Investment Limits and Returns:

There is no upper limit on the amount you can invest in this scheme. If you choose to invest 5,000 rupees every month for five years, your total investment will be 3 lakh rupees.

Total Returns after 5 Years:

With an interest rate of 6.7%, you will earn 56,830 rupees as interest on your investment. Therefore, after five years, you will have a total of 3,56,830 rupees.

Further Investment After 5 Years:

If you decide to continue investing for another five years, the total amount invested will reach 6,00,000 rupees. The interest earned on this amount will be 2,54,272 rupees, bringing your total to 8,54,272 rupees at the time of maturity after 10 years.

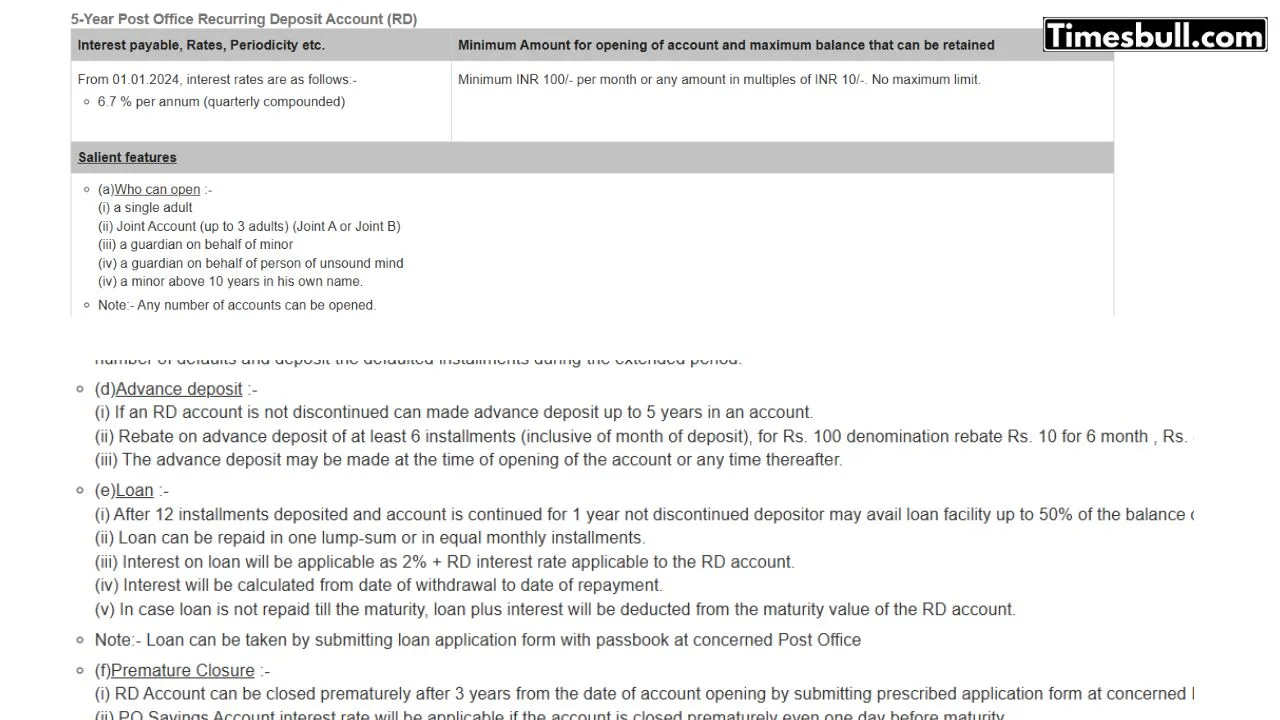

5-Year Post Office Recurring Deposit Account (RD) Overview

- Interest Rates (Effective from 01.01.2024)

- Interest Rate: 6.7% per annum (quarterly compounded)

- Minimum Monthly Deposit: 100 rupees, in multiples of 10 rupees

- Maximum Limit: No maximum limit on deposits

Who Can Open an RD Account?

- A single adult

- A joint account (up to 3 adults)

- A guardian on behalf of a minor

- A guardian on behalf of a person of unsound mind

- A minor above 10 years of age (in their name)

Note: Any number of RD accounts can be opened.

Disclaimer: The interest rates and terms mentioned are subject to change at the Bank’s discretion. Please verify details with the bank’s official website or branch before making any financial decisions. This platform does not take responsibility for any inaccuracies in the information provided.