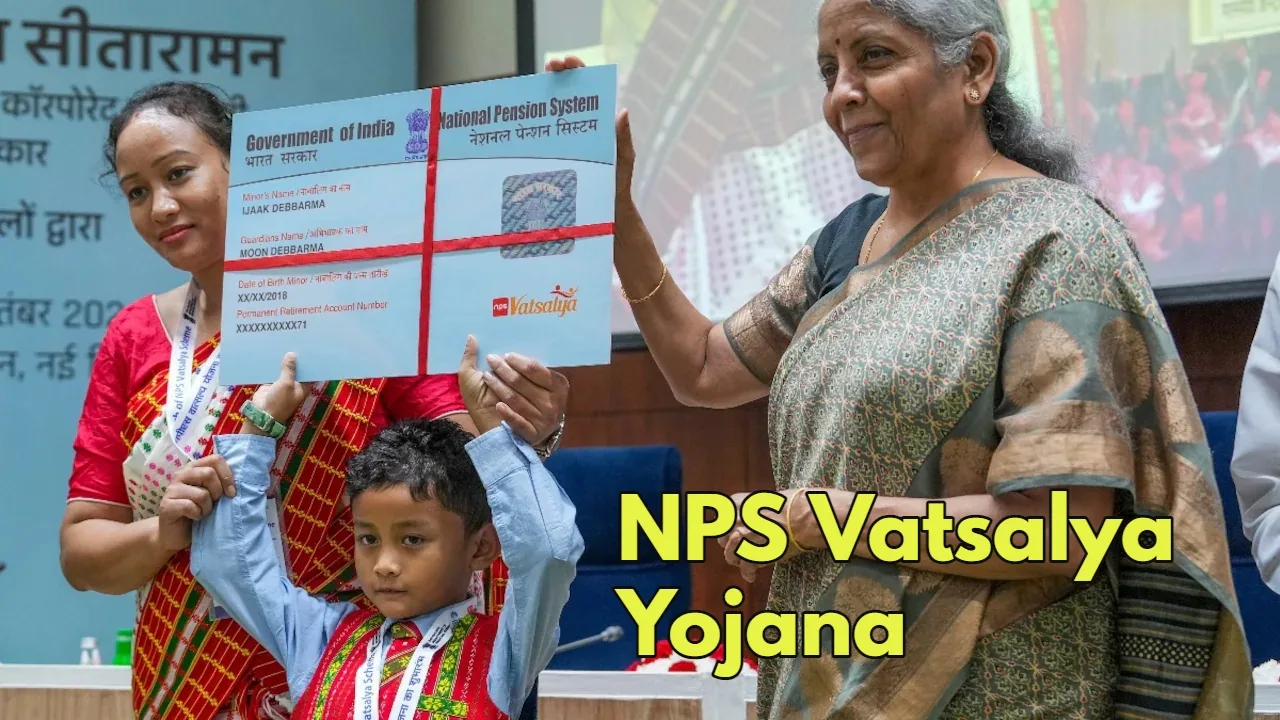

The National Pension System (NPS) Vatsalya Yojana, introduced in July 2024, offers a valuable opportunity for parents to secure their child’s financial future. This scheme allows parents to invest in a pension account for their minor children, leveraging the power of compounding to build a substantial corpus over time.

Key Features of NPS Vatsalya Yojana

Eligibility- Any minor below the age of 18 years can open an NPS Vatsalya account.

Minimum Investment- The minimum annual investment is ₹1,000, with no maximum limit.

Parental Investment- Parents can invest in the scheme on behalf of their child.

Transition to Standard NPS- When the child turns 18, the account will automatically transition to a standard NPS account.

Partial Withdrawal- After a lock-in period of 3 years, you can withdraw up to 25% of the accumulated amount three times.

Annuity Purchase- For amounts exceeding ₹2.5 lakh, you can purchase an annuity with 80% of the amount and withdraw 20% in a lump sum.

Death Benefit- In case of death, the entire accumulated amount will be transferred to the guardian.

How much return will you get

According to PIB Chandigarh, if you invest ₹10,000 annually, your total investment in 18 years will be ₹5 lakh. If you get an annual return of 10%, your total investment by the age of 60 will be ₹2.75 crore. If you get annual returns of 11.59% or 12.86%, your total investment could be ₹5.97 crore and ₹11.05 crore respectively.

Required Documents

To open the NPS Vatsalya account, you will to need the following important documents

Proof of the minor’s date of birth (birth certificate, school leaving certificate, matriculation certificate, PAN, or passport)

KYC identity and address proof of the guardian (Aadhaar, driving license, passport, voter ID card, NREGA job card, or National Population Register)

If the legal guardian is the NRI, the minor must have the NRE/NRO bank account.

NPS Vatsalya Yojana is a valuable tool for parents looking to secure their child’s financial future. By investing in this scheme, you can help your child build a substantial retirement corpus.

With its attractive features and potential returns, NPS Vatsalya Yojana is a worthwhile investment option for parents who prioritize their child’s financial well-being.